Real conversations with leaders, creatives, and thinkers … freedom, innovation … what’s true

Episode 271: Modern Dilemmas: Regulatory Capture, Global Governance, and the Surveillance State with Dr. Robert W. Malone

In this episode Bill Walton is joined by Dr. Robert Malone in a wide ranging and engaging discussion about modern societal and financial control mechanisms. Their great concern is the relentless and growing overreach of both governments and corporations into personal freedoms through the guise of security, safety and public health.

Robert W. Malone is an internationally recognized scientist/physician and the original inventor of mRNA vaccination as a technology. He holds numerous fundamental domestic and foreign patents in the fields of gene delivery, delivery formulations, and vaccines: including for fundamental DNA and RNA/mRNA vaccine technologies. He has developed some 100 scientific publications with over 14,000 citations of his work.

He now focuses on daily podcasts, interviews, op-eds, advocacy with legislators and building a twitter feed of over a million people.

His life changed from that of a scientist to an advocate because of his personal experiences and concerns regarding the safety and bioethics of how the COVID-19 genetic vaccines were developed and forced upon the world. He discovered the many short-cuts, database issues, obfuscation and frankly, lies told in the development of the Spike protein-based genetic vaccines for SARS-CoV-2.

Some of the topics covered:

The regulatory capture of the federal government has warped and shaped the work of Congress and Federal agencies to such an extent that they no longer represent what is in the best interests of the nation, the world, and humanity.

WHO's Pandemic Treaty is intended to override most of our national sovereignty in health policy decisions, effectively allowing a global body to dictate local health measures.

Central Bank Digital Currencies (CBDCs) which have the potential to be a sinister tool for government financial surveillance and social control.

Financial Privacy Concerns The payment processor Stripe, which recently demanded Malone's financial details, reflecting broader concerns about privacy and autonomy in financial transactions.

Labeling Dissent as extreme, such as "far-right" or "Nazi," to delegitimize and silence criticism, comparing it to historical tactics used during the McCarthy era.

Surveillance and Control under the guise of safety and security, suggesting a slippery slope toward more intrusive governmental and corporate practices.

Robert Malone is a courageous and deep thinker, a man who should be listened to.

Episode 270: Voices in the Supreme Court: Protecting Our Free Speech with Aaron Kheriaty and Jenin Younes

On March 18, the Supreme Court heard oral arguments in the case Murthy v. Missouri challenging whether the government can induce social media platforms like Twitter and Facebook to censor constitutionally protected free speech.

A sinister web of federal agencies, the White House, social media platforms, NGOs and others are orchestrating a vast system of censorship to suppress viewpoints that contradict “preferred government narratives”about COVID-19 policies, climate change, election integrity and other issues that should be open to free & fair debate.

The Supreme Court is being asked to decide on a lower court injunction that ruled that the Biden White House, the FBI, the Department of Justice, the Surgeon General, the CDC, the Department of Health and Human Services and many other federal agencies are not permitted to communicate with or coerce social media companies for “the purpose of urging, encouraging, pressuring, or inducing in any manner the removal, deletion, suppression, or reduction of content containing protected free speech.”

Joining Bill in this episode are two people who were inside the Supreme Courtroom on March 18, plaintiff Aaron Kheriaty MD and his lawyer Jenin Younes.’

Aaron, a physician specializing in psychiatry, was fired from the University of California after challenging its Covid vaccine mandate in Federal Court.

Jenin’s with the New Civil Liberties Alliance and served as senior special counsel on the Weaponization Subcommittee.

Episode 269: How the United States’ Arrogance, Ignorance and Greed Fueled China’s Rise with Jim Fanell and Brad Thayer

After achieving victory in the Cold War against the Soviet Union, US political leadership, starting with the Clinton Administration, has made a continuing string of strategic blunders that have brought the United States to the point where - after building China up for decades - we face an enemy determined to become the new global hegemon and that now possesses equal economic, military and diplomatic resources.

To learn how this came about, in this episode Bill talks with James E. Fanell and Bradley A. Thayer, Ph.D, authors of

Embracing Communist China: America’s Greatest Strategic Failure.

Jim Fanell, a retired U.S. Navy captain and the former Director of Intelligence and Information Operations for the U.S. Pacific Fleet, is now a Government Fellow at the Geneva Centre for Security Policy.

Brad Thayer is an expert in Chinese grand strategies and the history of Chinese and Western strategic thought; and a former visiting fellow at Magdalen College, University of Oxford.

“How did China go from an underdeveloped country in 1990 with about 0.6 of 1% of world gross domestic product to over 20% of world GDP today?” asks Brad.

“The answer in large part is that the United States aided and abetted the rise of the Chinese Communist Party and kept it in power. That has never happened before in international politics where one state, the dominant state, has funded the rise of an enemy.”

U.S. foreign policy toward the People’s Republic of China (PRC) has been dominated by the so-called “Engagement School” since the end of the Cold War. They believed that U.S. political and economic engagement with the Chinese Communist Party (CCP) would transform the PRC into a “responsible stakeholder” in the Western economic system and, ideally a democracy. Of course, none of that happened.

Instead, the Engagement School saved the CCP and ensured that the PRC became wealthier and more powerful year-after-year and used that power to re-make the international order to suit the CCP’s interests and to threaten U.S. national security, allies, and partners.

“Engaging” with China has led to the offshoring of manufacturing jobs, the loss of intellectual property, and making the U.S. energy future dependent on China, just to name a few of our strategic blunders.

“We thought we could make China and CCP become more like us, that they would see the value of the being part of a US dominated system created in the post-World War II era. We assumed they would just naturally drift into becoming a liberal democracy. So we didn't fundamentally understand communism. We didn't understand the Chinese Communist Party's commitment to that ideology,” explains Jim.

The Trump administration began the difficult task of ending Engagement. However, under Biden, it has now returned in a supercharged form.

The Biden “reset” began in earnest in May when CIA Director Nicholas Burns made a secret trip to Beijing to meet with his Chinese counterparts. Then began a cavalcade of visits to the PRC from senior Biden officials: Secretary of State Anthony Blinken, National Security Advisor Jake Sullivan, Treasury Secretary Janet Yellen, Climate Czar John Kerry, and Commerce Secretary Gina Raimondo who was most explicit regarding why nothing could jeopardize the approximately $750 billion per year trade relationship with the PRC.

“But the apotheosis of the engagement paradigm was the summit meeting in November between Xi and Biden. The meeting with Biden was just Xi’s doormat to get to what really mattered: the meeting with the 400 business leaders,” explain Jim and Brad.

“Never in our history have Americans so openly and brazenly celebrated a communist and murderous dictator. It was an appalling and shameful moment in American history.”

“The U.S. has little to show in return for all these meetings, except for the loss of face and its own national power—again, year-after-year. It is stunning that so few Americans have asked what good has America received from the Engagement School. The elite have gotten wealthier, so they and the CCP are the winners. But it’s the Chinese and American people that bear the costs.”

Episode 268: Conspiracy: Why FDR's White House Ignored a Chance to Change History with Chris Farrell and Shea Bradley-Farrell

“What if in 1943 President Franklin Delano Roosevelt and his White House advisors had acted on an offer from high-ranking German officials that they were prepared to kidnap Adolf Hitler and all of his top cronies. They would then turn Hitler over to the United States and sign an armistice ending the war with Germany.

The German high officials wanted then to join with the United States to stop the Communist Soviet Union from advancing in Europe. They had a well-thought out plan as to which units they knew were loyal, what units they knew would actually move on the Wolf's Lair, Hitler's Prussian, and the East Prussian headquarters.

FDR learned of this proposal from a man the Germans believed would be their most credible emissary:

George H. Earle III, a Main Line Philadelphia millionaire, war hero awarded the Navy Cross, Pennsylvania governor, Ambassador to Austria and Bulgaria, friend and supporter of Franklin Roosevelt, generous donor to humanitarian causes, colorful playboy, and spy.

Yet FDR did not act on the stunning offer, and the rest as they say, is History. The Soviets conquered part of Germany and all of Eastern Europe and closed it behind an iron curtain that would endure for over four decades.

Here to tell this story is Chris Farrell, who for the last 25 years has been the Director of Investigations & Research at Judicial Watch and author of “Exiled Emissary: George H. Earle III” and

Dr Shea Bradley Farrell, author of “Last Warning to the West”, the founder of Counterpoint Institute and who has written extensively about the agonies of Eastern Europe under Communism.

“This is not one of these books that examines an alternative history,” explains Chris. “Everything in the book is documented, for example, from the National archives, the Pennsylvania State Archives in Harrisburg, or the Pennsylvania Historical Society in Pennsylvania. Or from personal records from the Earle family.”

Why this story matters today is not just that FDR did not act but why he didn’t. As records have become public, we have learned that were many staunch supporters of the Soviet Union and its Marxist social experiment in both the FDR and Truman White Houses. Alger Hiss was FDR’s key aide at Yalta.

“What Earle was saying was, “Look, the real threat is the Soviet Union. We may have been allied during the war for whatever reason you want to explain, but they're a civilizational threat."”

But many in the 1940s White House did not want to act against the Soviet Union. They supported it.

The Soviets then. China today. The United States has a long troubled history of “elite capture.”

Chris and Shea tell a compelling story. You can learn much about history from this episode. But it’s how it reflects on today that’s really chilling. What does John Kerry say when he’s meeting with the Chinese?

Episode 267: CO2: The Miracle Molecules with Dr Will Happer and Greg Wrightstone

Carbon dioxide, or CO2, is portrayed as the worst villain in climate alarmism’s pantheon of satanic gases.

The claim is that increasing levels of greenhouse gases are purportedly driving atmospheric warming to dangerous and unprecedented levels which is said to be leading to ever increasing natural disasters, severe weather events and human health concerns.

But what if these claims are wrong, catastrophically wrong.

What if, rather than being at unprecedented high levels, CO2 is at one of its lowest concentrations in the long history of the Earth and that the modest warming anticipated from increasing concentrations of greenhouse gases will be benign. More carbon dioxide will bring huge benefits to agriculture, forestry and life in general.

Returning guests Dr Will Happer Professor Emeritus of Physics at Princeton University and geologist Greg Wrightstone, both with the CO2 Coalition, make a convincing case in this episode for just that. Atmospheric CO2 is the primary carbon source for life on Earth.

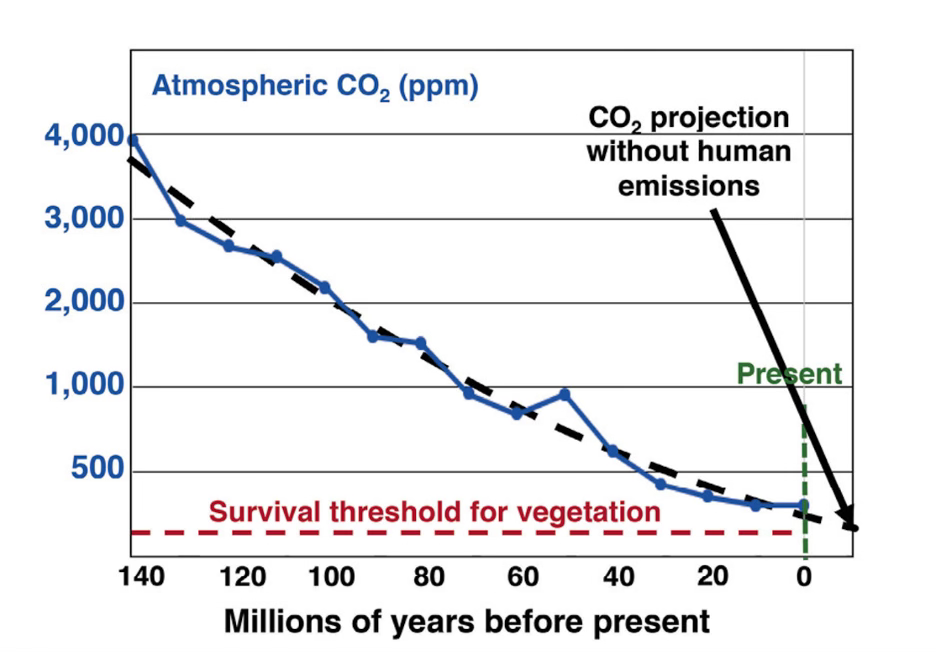

Carbon dioxide concentrations - in part due to human emissions - are slowly growing from near-famine, pre-industrial values toward levels that are optimum for plant growth and which have prevailed over most of the geological history of higher life forms.

Carbon dioxide, at a current concentration of about 420 ppm, represents just 0.04% of the atmosphere, or about 420 molecules out of every million. Current levels are an incredibly small percentage of the atmosphere, albeit a critical one, as advanced plant life could not survive without at least 150 ppm. Recent declines in concentration have pushed the world dangerously close to that 150 ppm “line of death.”

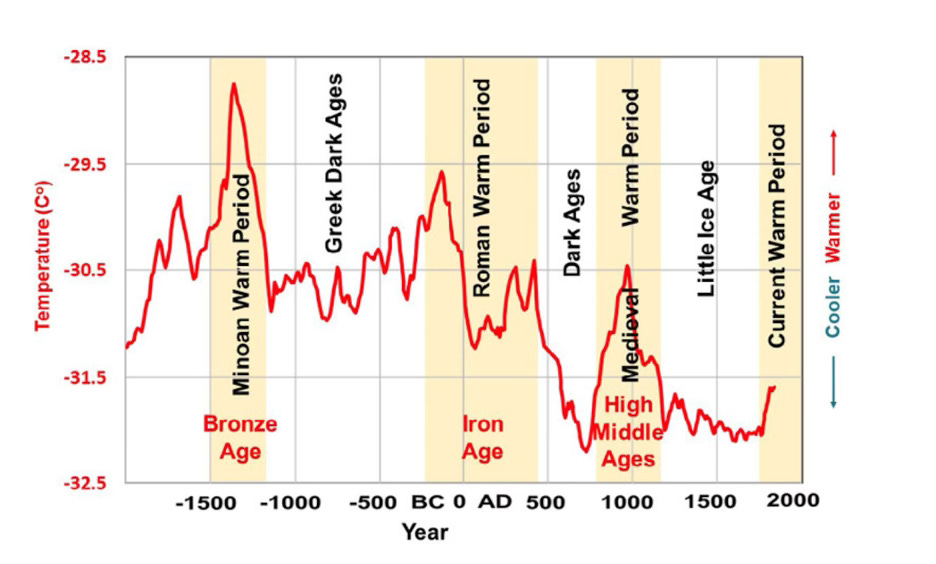

Nearly all great leaps in human history occurred during warm periods. Before climate science became politicized, historians called warm periods “climate optima” because Earth’s ecosystems and humanity benefited from the blessed warmth.

Contrary to the demonization of the gas, CO2 is essential to life on Earth. CO2 is not a poison. Without CO2, there would be no photosynthesis, no plant food and insufficient oxygen to breathe. Just some of the benefits of CO2:

• Increasing crop growth

• Increasing soil moisture

• Shrinking deserts

• Expanding forests

• Lengthening growing seasons

• Declining cold-related mortality

What we should be worried about is that throughout most of Earth’s history, carbon dioxide existed in beneficially high levels that were multiples of our current concentration. Geological sequestration of CO2 into fossil fuels has depleted our atmosphere to levels below the optimum for plant growth.

The great irony is that through the burning of fossil fuels, the carbon stored in the remains of ancient plants and organisms is now being liberated and helping to return the planet’s atmosphere to more beneficial levels of CO2.

We can correctly refer to fossil fuels as “natural solar-powered energy” or, if you like, giant solar energy storage batteries!

Without fossil fuels there would be no reliable, low-cost energy worldwide and less CO2 for photosynthesis to make food. Eliminating fossil fuels to attempt to reduce CO2 emissions would be disastrous for the world’s people, especially for the two billion impoverished poor.

An underreported consequence of the “green” energy transformation is the loss of habitats and species.

The “green” solution to a non-existent climate crisis is to encourage a great acceleration in habitat loss by abandoning efficient fossil fuels for inefficient wind and solar energy that requires vast swaths of forest, grasslands and farmlands for solar and wind installations and further habitat loss through:

-

open-pit mining of minerals needed for batteries, photovoltaic cells and electric transmission,

-

conversion of diverse jungle habitat to plantations for biofuel,

-

large-scale electricity transmission lines and

-

destruction of mature forests to make wood pellets as biofuel.

So-called green energy is causing the destruction of massive numbers of birds, bats and insects slaughtered by wind turbines. Offshore wind projects are killing whales, dolphins and other cetaceans.

We have been seized by a great madness.

Under the false claims of coming calamity, bureaucrats and politicians seek to shut down coal-fired power plants, kill the internal combustion engine, ban natural gas for home use and advance the misguided objective of a “net zero” economy.

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

- Charles MacKay

“What historians will definitely wonder about in future centuries is how deeply flawed logic, obscured by shrewd and unrelenting propaganda, actually enabled a coalition of powerful special interests to convince nearly everyone in the world that carbon dioxide from human industry was a dangerous, planet-destroying toxin. It will be remembered as the greatest mass delusion in the history of the world—that carbon dioxide, the life of plants, was considered for a time to be a deadly poison.”

- Dr. Richard Lindzen

“I don’t see a whole lot of difference between the consensus on climate change and the consensus on witches. At the witch trials in Salem the judges were educated at Harvard. This was supposedly 100 per cent science. The one or two people who said there were no witches were immediately hung. Not much has changed.”

- Will Happer

Viewing page 1 of 56|Next Page